FEATURED LISTINGS

19320 33rd Ave W Lynnwood

Constructed in 1999, the three-story building boasts a visually striking architectural design that is prominently visible to Interstate 5 traffic. The building is comprised of approximately 43,504 square feet of space and occupies a parcel of 1.34 acres or 58,370 square feet.

Point Ruston Building 18

Building 18 is a 21,354 SF building with 9 retail suites. The property is currently 96.7% occupied with restaurant and service-based tenants including Farelli's Wood Fire Pizza, Intaglio Salon, and Ice Cream Social.

Point Ruston Building 8

Building 8 is a 10,110 SF building with 4 retail suites. The property is currently 82.2% occupied with MultiCare Indigo Urgent Care, Obee Credit Union, and Rebels & Lovers clothing store.

LATEST POSTS

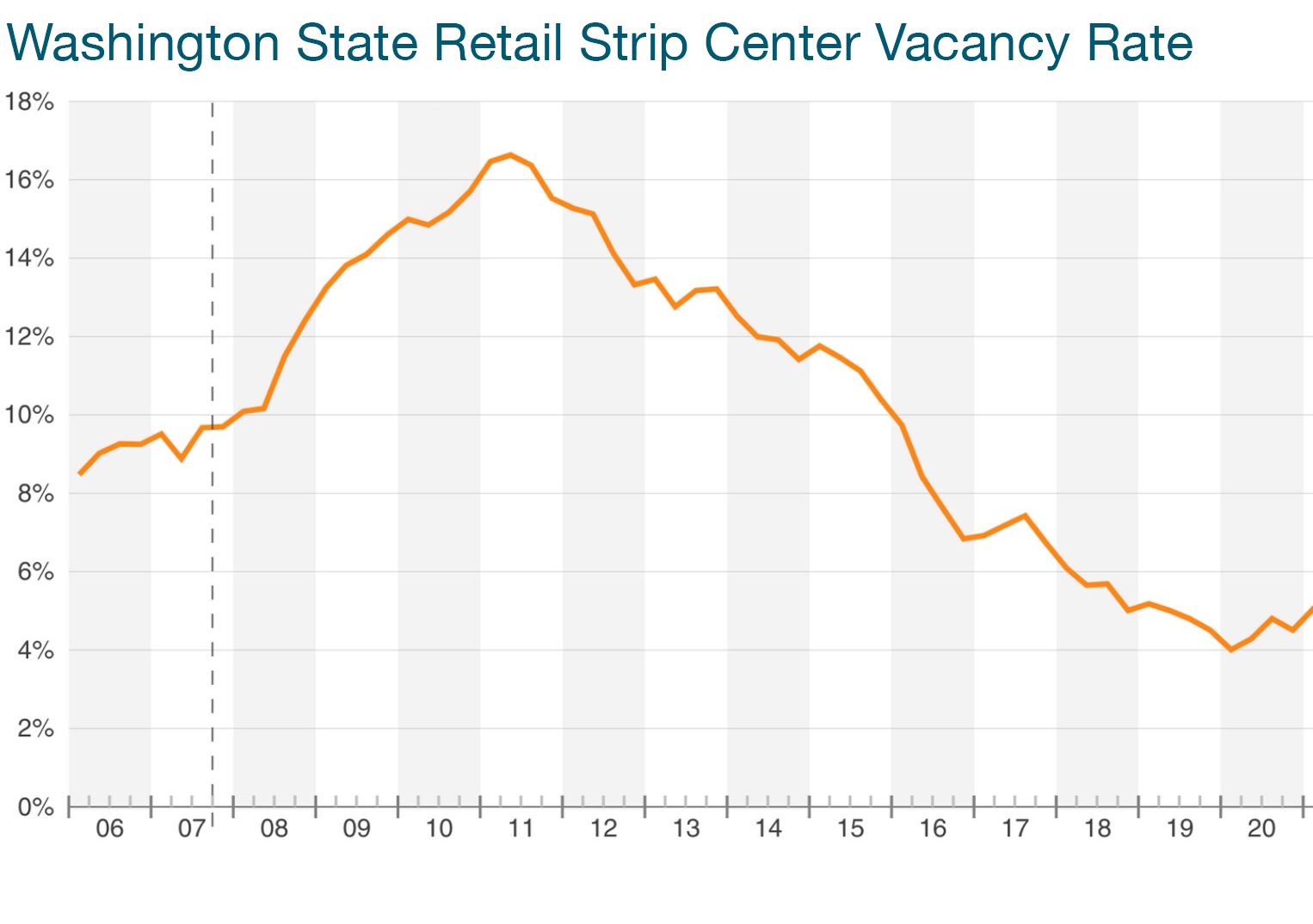

Pacific Northwest Strip Retail Remains Strong

The pandemic has profoundly impacted the commercial real estate industry, causing significant challenges across all asset classes. Retail real estate, in particular, has faced uncertainty and disruption. However, despite current lending challenges in commercial real estate, strip centers are emerging as a favored asset class. One reason is their resilience.

Stay in the loop

Join our email list to receive our latest listings and monthly newsletter directly to your inbox.

/800x450/GfEVdiQa.JPG)

/800x450/O8VXOmNy.jpg)

/800x450/oHjuvlkR.jpg)